บริการรับชำระเงินผ่าน QR Code สะดวก ปลอดภัย ชำระได้ทุกธนาคาร

บริการชำระค่าสินค้าด้วยคิวอาร์โค้ด

API Security

Bangkok Bank leverages several security and authentication protocols for the safeguard of all parties involved. This section describes the OAuth (open-standard Authorization) protocol and JWT (JSON Web Token) standards that we require you to adhere to harness this API.

Prerequisites:

- Merchants must be registered with Bangkok Bank developer portal to obtain the Consumer ID and Consumer secret keys for application integration purposes.

- Always use HTTPS (TLS 1.2) to ensure the security of data in transit.

- Keep your consumer secret and access tokens always secure.

- Access tokens should be handled and stored securely, and never exposed to unauthorized parties.

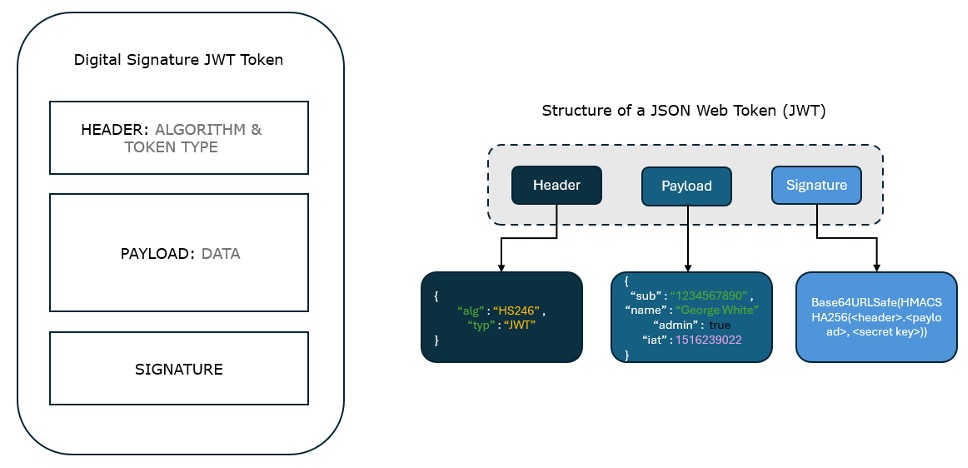

Digital Signature & Structure (JWT)

JSON Web Token (JWT) is a fundamental security component for Bangkok Bank APIs. In every API request to the Bangkok Bank API Gateway, inclusion of a JWT in the header is crucial. This token, resulting from payload encryption using the merchant's private key, undergoes verification by Bangkok Bank using the merchant-provided public key. This process ensures the validity of the request, augmenting our OAuth Authentication for dual-layer security against cyber threats such as man-in-the-middle attacks.

In general, JSON Web Tokens (JWTs) consist of three main components: the Token Header, the Token Payload, and the Signature. These components work together to encode information securely for transmission between parties.

Understanding how Bangkok Bank implements JWT is crucial for successful integration. The following steps outline what are required from a developer's perspective:

- Preparing the Public and Private Key pair

- Before initiating any API requests, merchants need to generate a secure Public and Private Key pair. These keys will be crucial for the cryptographic operations involved in JWT processing.

- Preparing the Payload

- As part of an API request, merchants construct a JSON payload containing essential information. This JSON payload serves as the basis for the JWT claim and carries details pertinent to the specific request.

- This JSON payload is used as the JWT claim.

- Generating the JWT

- The merchant uses their private key to sign the JWT. This involves encoding the header and payload, concatenating them, and then applying the signature algorithm using the private key.

- The result is the JWT.

- Verifying the JWT

- Bangkok Bank, upon receiving the API request, uses the merchant's public key to verify the JWT.

- The signature is verified, and claims within the payload are extracted and validated.

Remark:

- The signature token follows the standard JSON Web Token format RFC 7519

By following these steps, merchants can seamlessly integrate JWT authentication with Bangkok Bank's API, ensuring secure and reliable communication. It is recommended to securely store and manage the generated keys throughout the implementation process.

For more details on how to generate JWT for Digital Signature, please refer to our guide here.

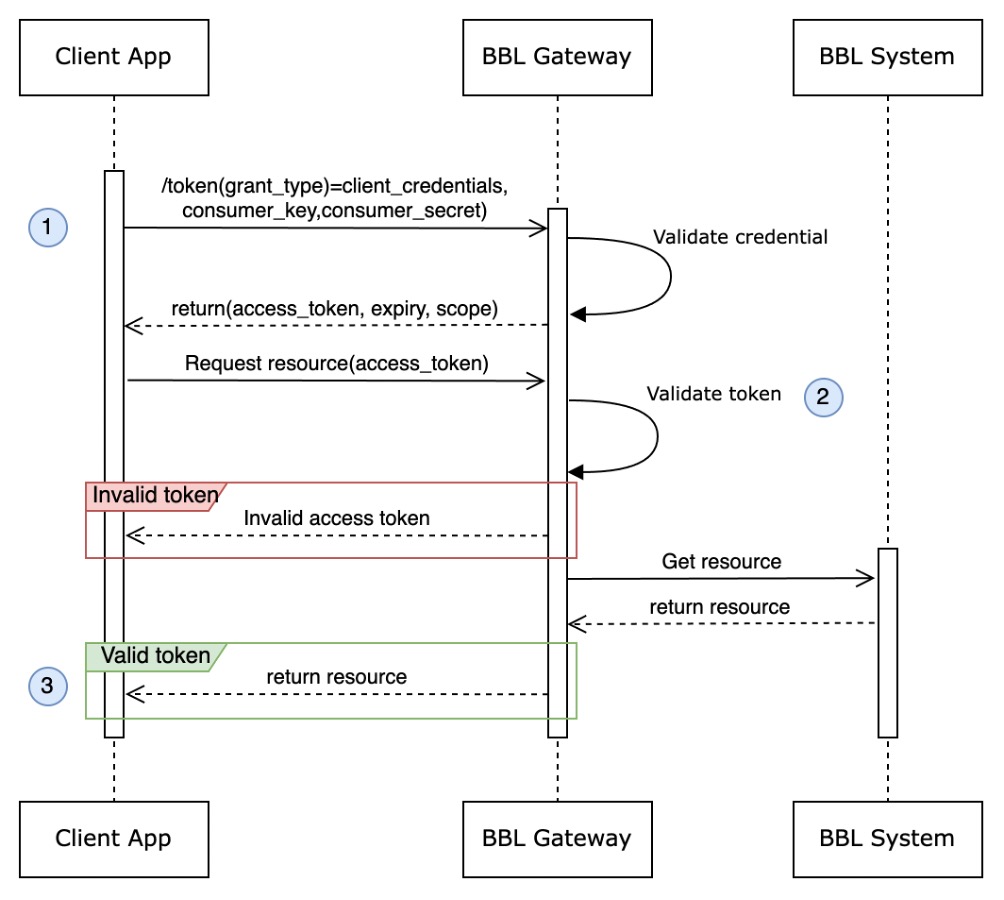

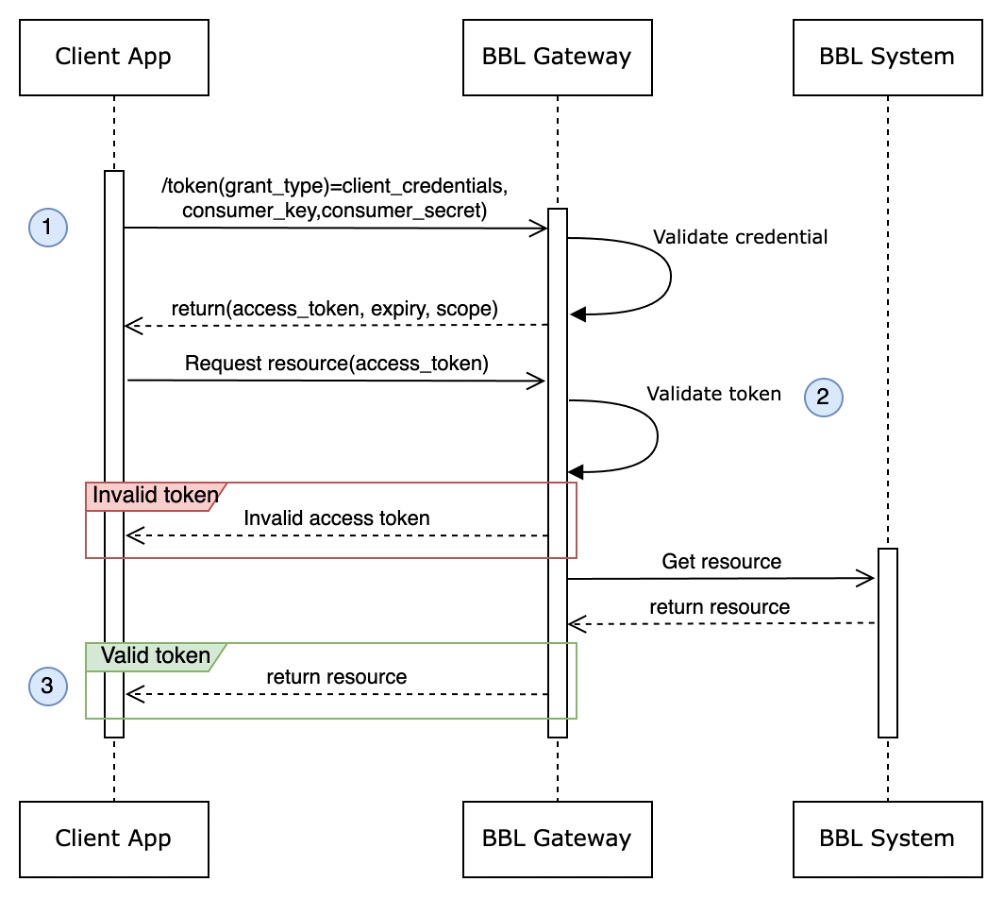

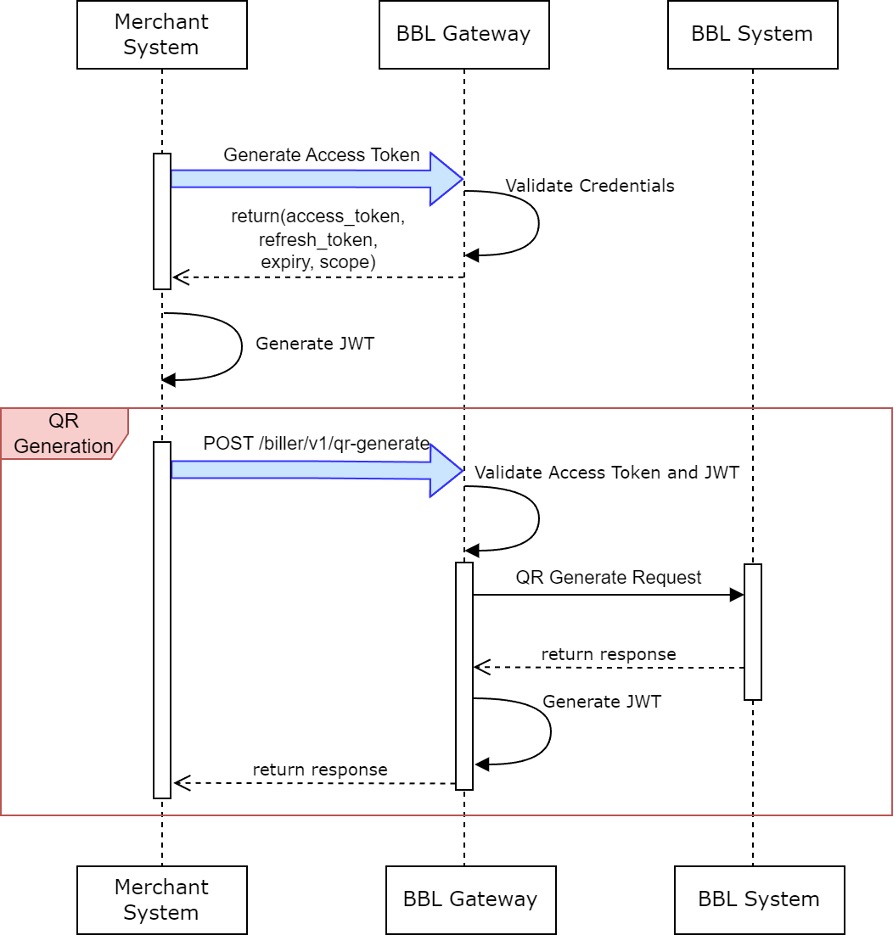

Generate Access Token (OAuth Client Credential)

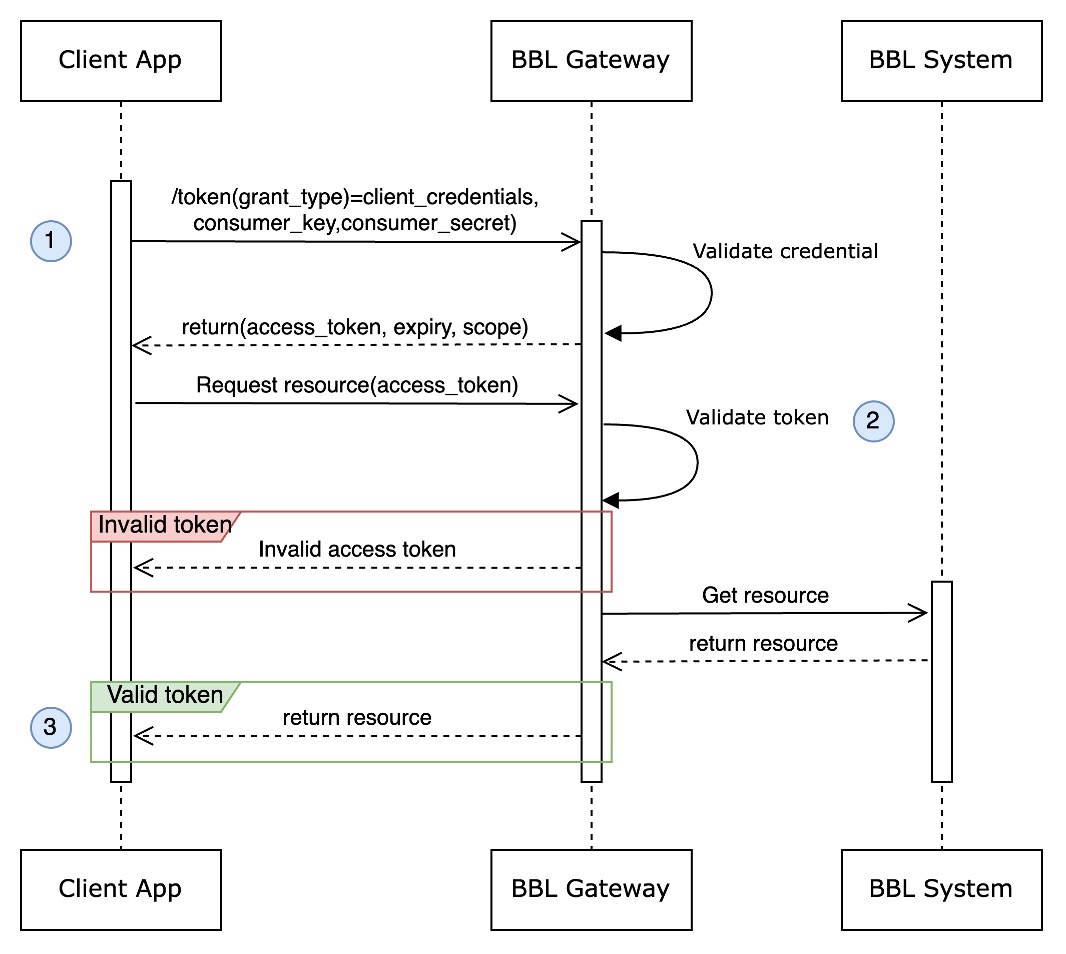

Bangkok Bank’s Authorization follows OAuth v2.0 client credentials grant type to secure authentication between servers. The following flow diagram illustrates the client’s credentials flow with Bangkok Bank API Gateway serving as the authorization server.

A request is made to Bangkok Bank API Gateway (the API proxy), and Bangkok Bank API Gateway is responsible for validating the access token before passing the API call along to the target backend systems.

Here is the summary of the steps required to implement the client credentials code grant type.

- Client requests an access tokenTo receive an access token, the client POSTs an API call to Bangkok Bank API Gateway with the values for consumer ID and consumer secret obtained from a registered developer app.

- Bangkok Bank API Gateway validates the credentialThe API calls are sent to the OAuth service. This endpoint has a policy attached to it that validates the app's credentials from the client. This policy validates whether a client application is authorized or not.

- Bangkok Bank API Gateway validates the credentialIf the credentials are valid, Gateway then returns an access token to the client valid for 24 hours. If not, an error is returned.

With a valid access token, the client can make calls to the protected API.

POST /oauth/accesstoken

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/x-www-form-urlencoded

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/oauth/accesstoken

- PROD:https://api.bangkokbank.com/oauth/accesstoken

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Basic authentication Token encode with Base64 String = {consumerKey}:{consumerSecret} Basic {token} | Basic c3FIOG9vSGV4VHoAyg5T1JvNnJoZ3ExaVNyQWw6WjRsanRKZG5lQk9qUE1BVQ |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| grant_type | String | 20 | Y | OAuth grant type | client_credentials |

| scope | String | 50 | N | Scope of access proxy | READ CREATE |

Request Example

curl --request POST 'https://{{api-host}}/oAuth/accesstoken' \

--header 'Authorization: Basic QkF6V29tNGxLa3VVTjdNVVYxTFlPR2hyMllkS0ZoUVc6R01idmJScVRYN3NrT1FWVQ==' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'scope=CREATE READ' \

--data-urlencode 'grant_type=client_credentials'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| accessToken | String | 100 | Y | Token for call API | ds9PIkzbNwXffsDHLPW4auli0NAN |

| expiresIn | String | 100 | Y | Time to expire token | 86399 |

| scope | String | 100 | Y | Scope token | READ CREATE |

Response Body Example (Success)

{

"accessToken": "ds9PIkzbNwXffsDHLPW4auli0NAN",

"expiresIn": "86399",

"scope": "READ CREATE"

}Response Body Example (Failure)

{

"responseCode": "1001",

"responseMesg": "grant_type not found"

}API Overview & Specification

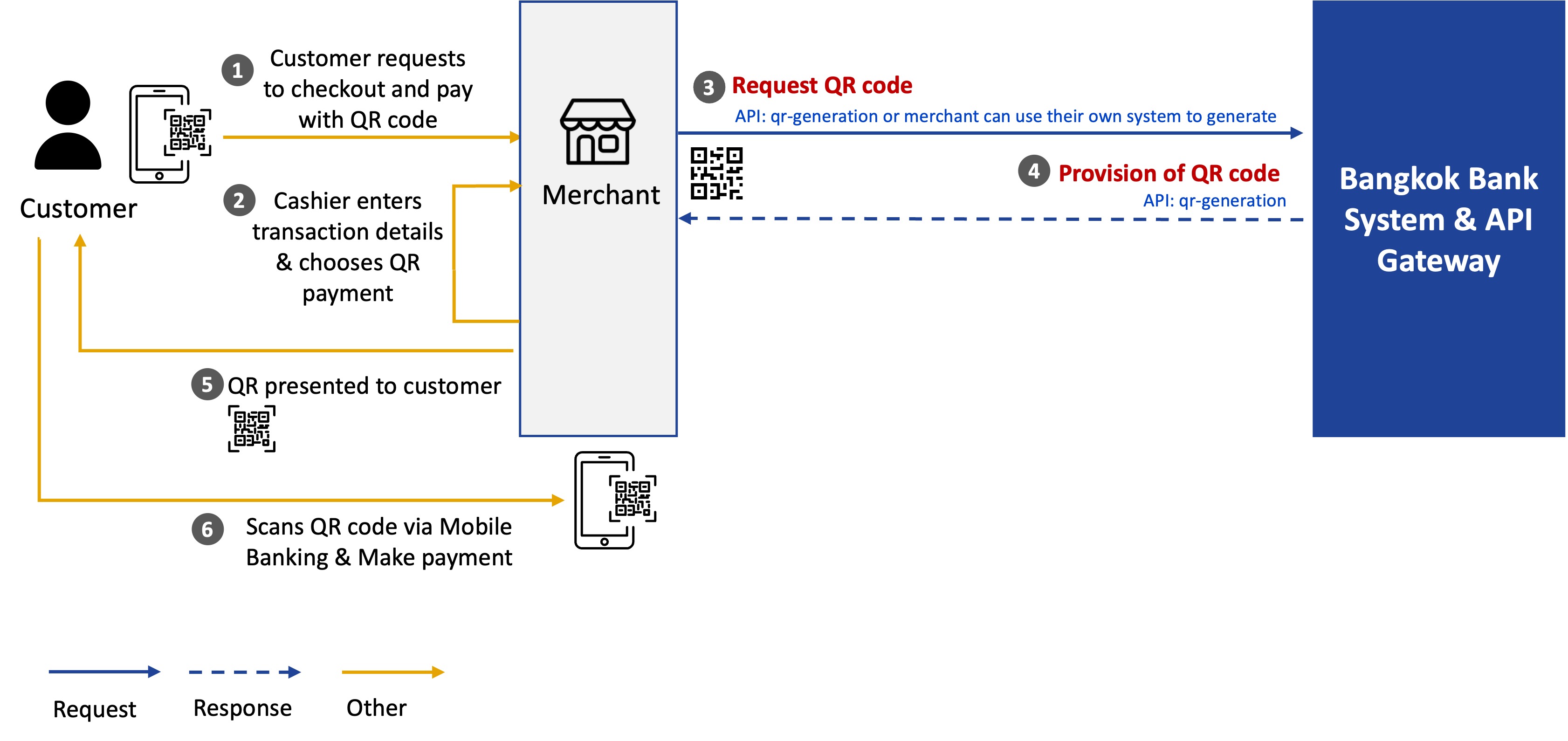

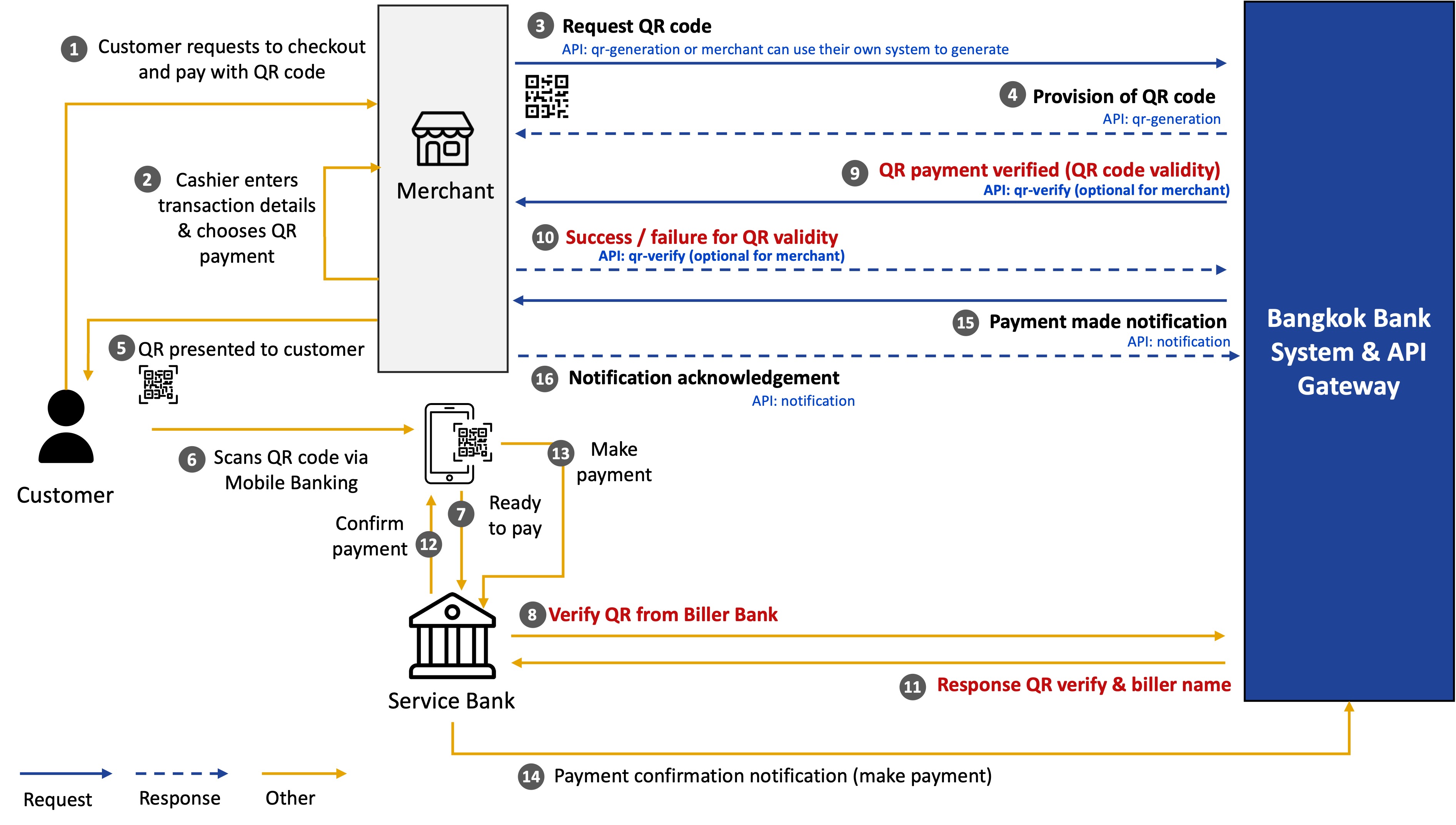

Thai QR Code Generation

This API, as part of the broad product suite, specifically enables you to offer Thai QR payment capabilities to your customers through your application solution. The QR code is generated on request at checkout and has your business details and the purchase value embedded. This allows the customer to scan and make payment to you with confidence knowing they are transferring money to the correct business and of the correct value.

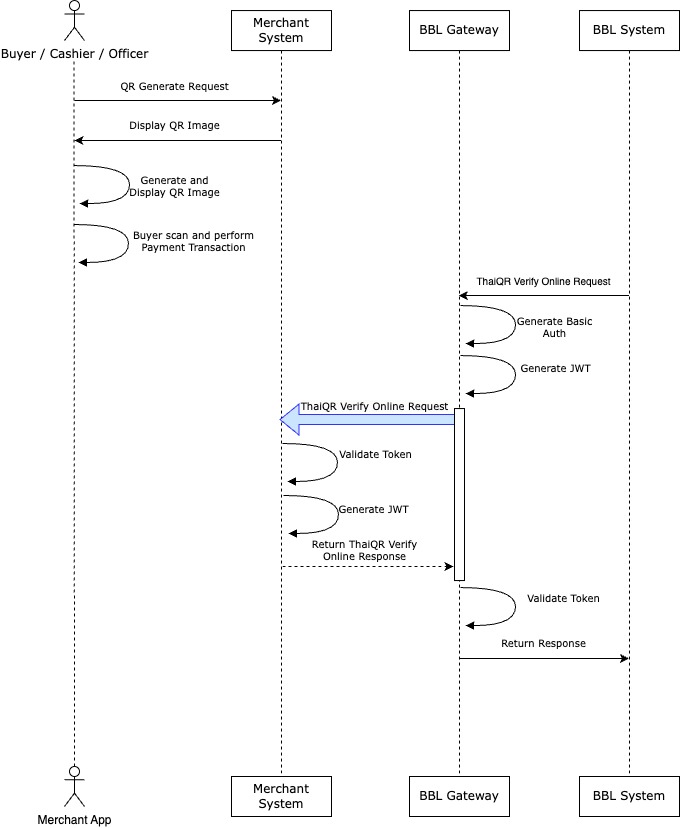

Thai QR Verify Online

When a customer scans the QR code from mobile banking, Bangkok Bank Gateway sends an API request to merchant specified endpoint with QR information to verify the eligibility of QR code before allowing the buyers to make the payment.

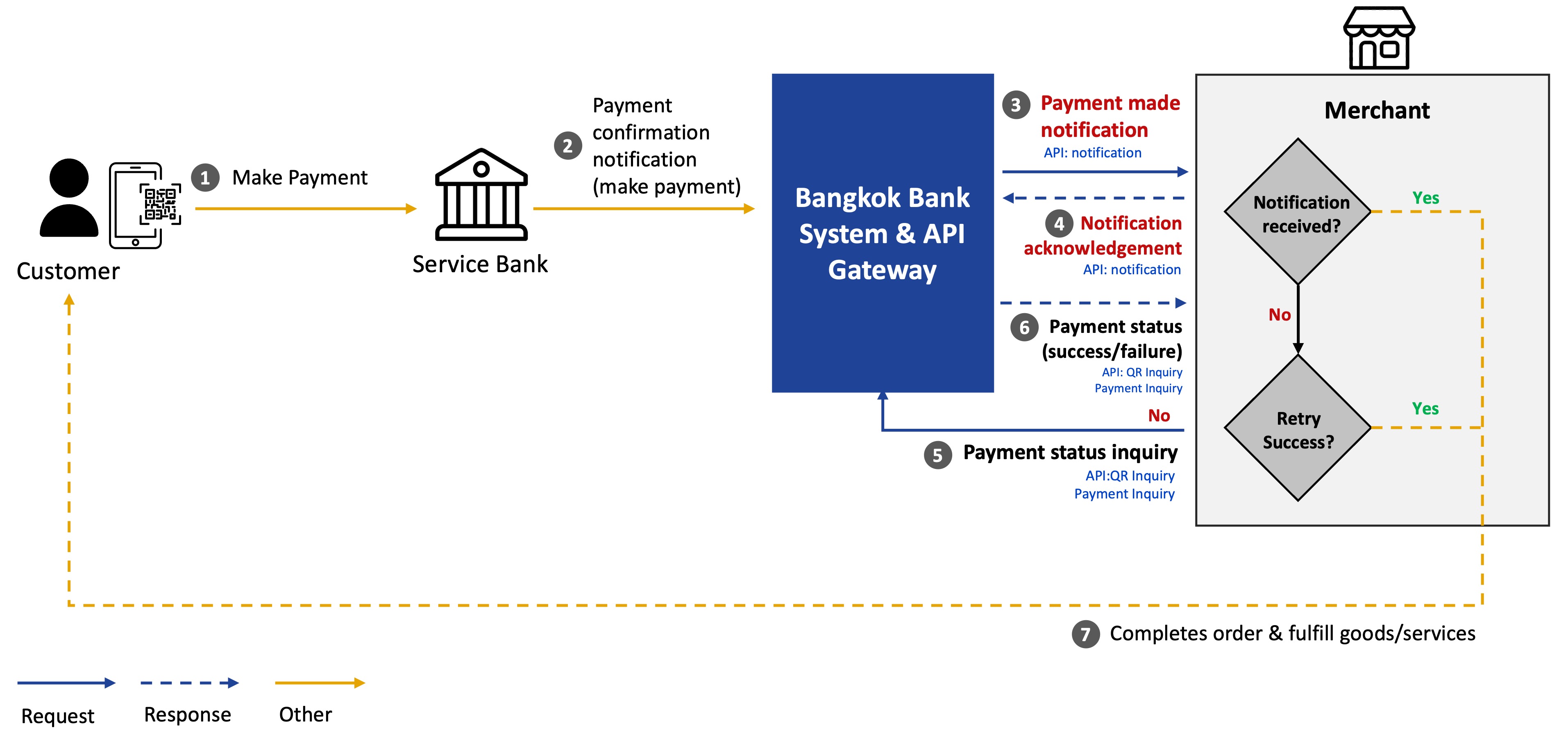

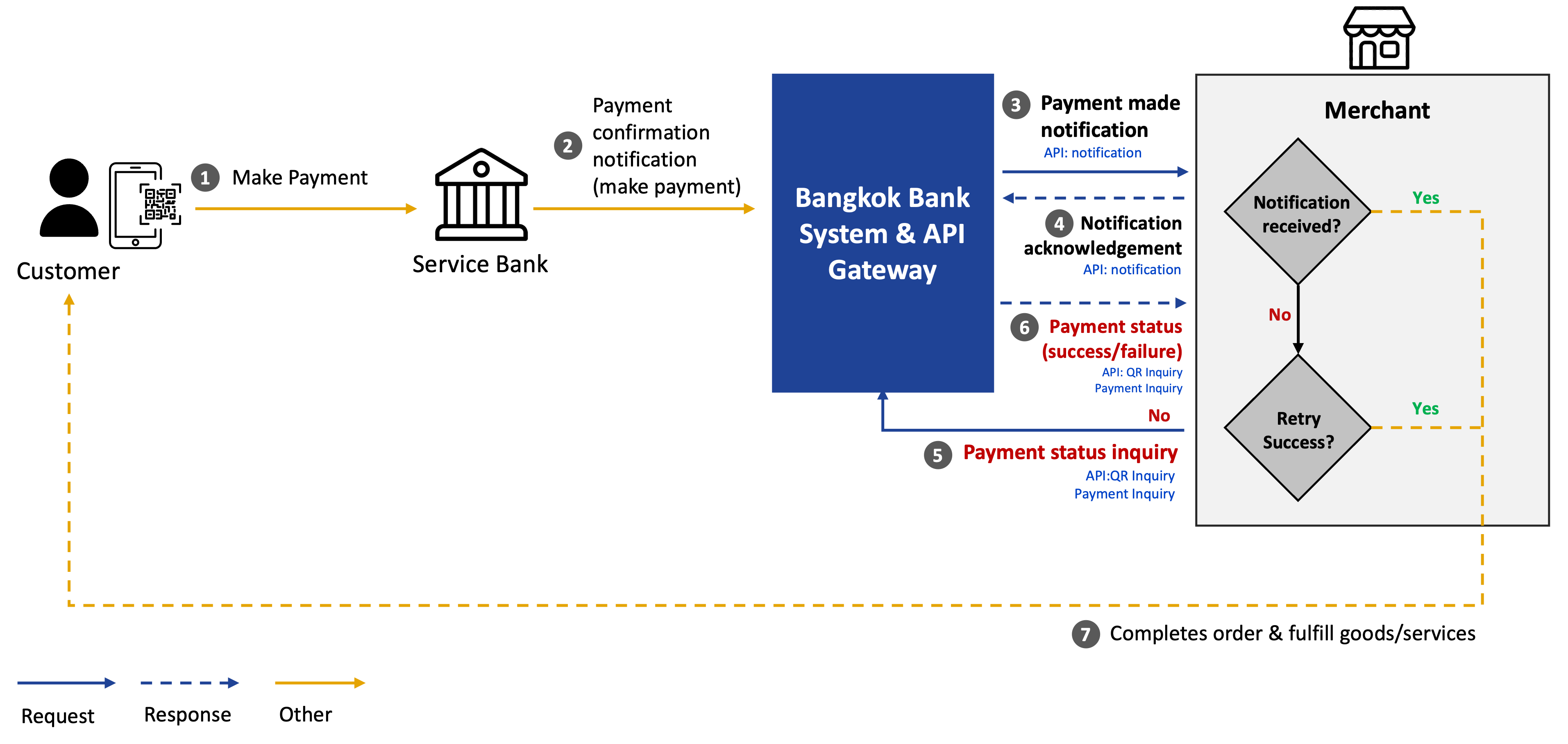

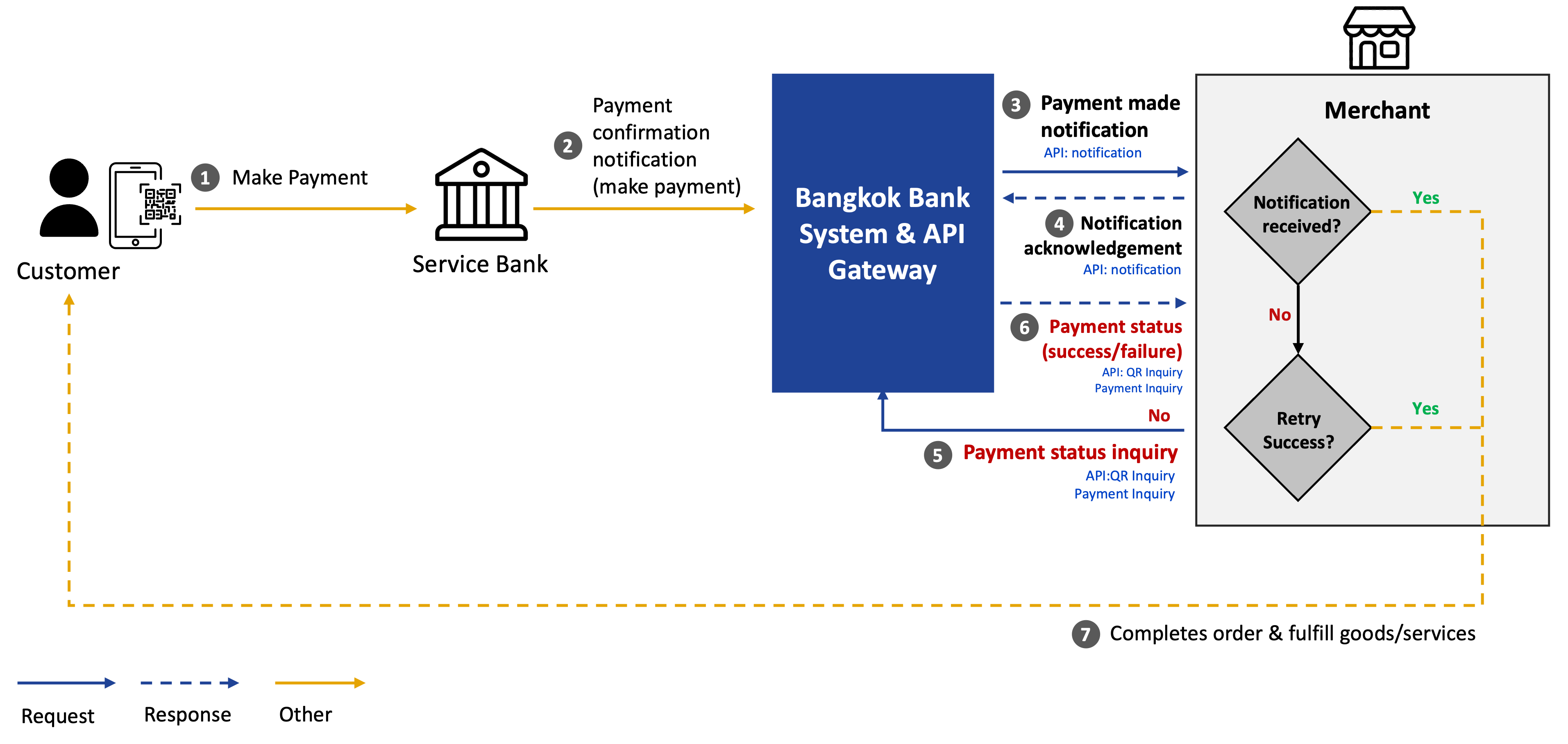

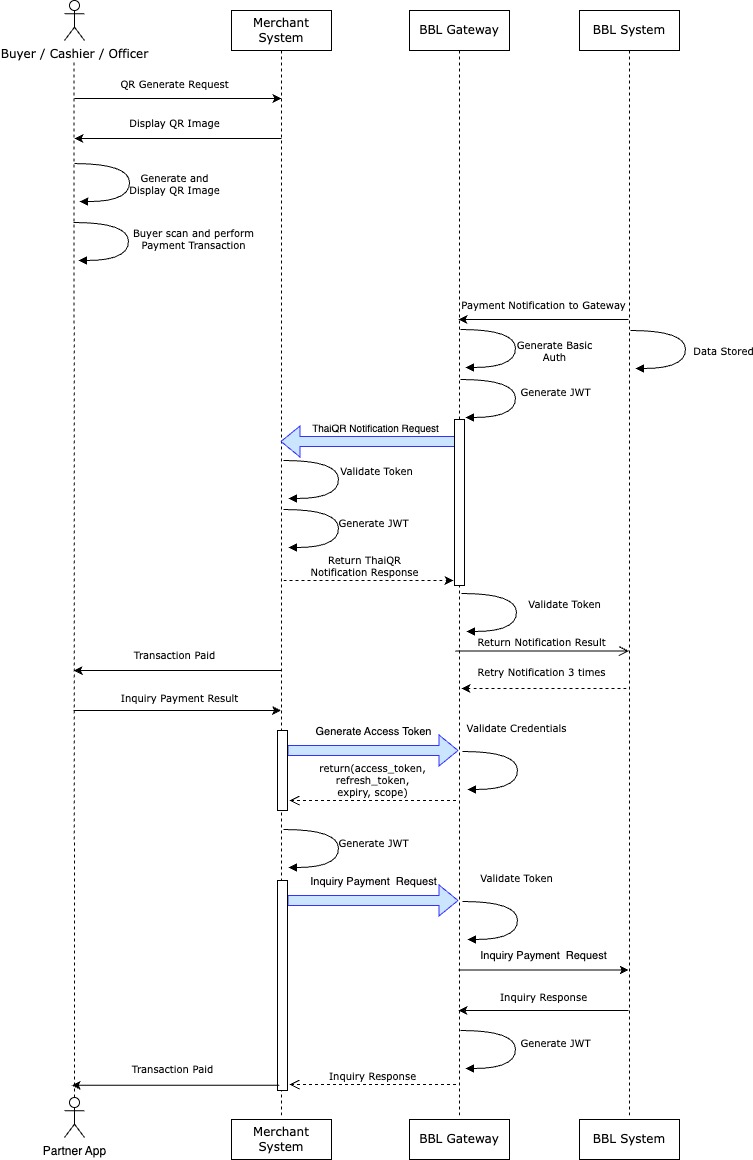

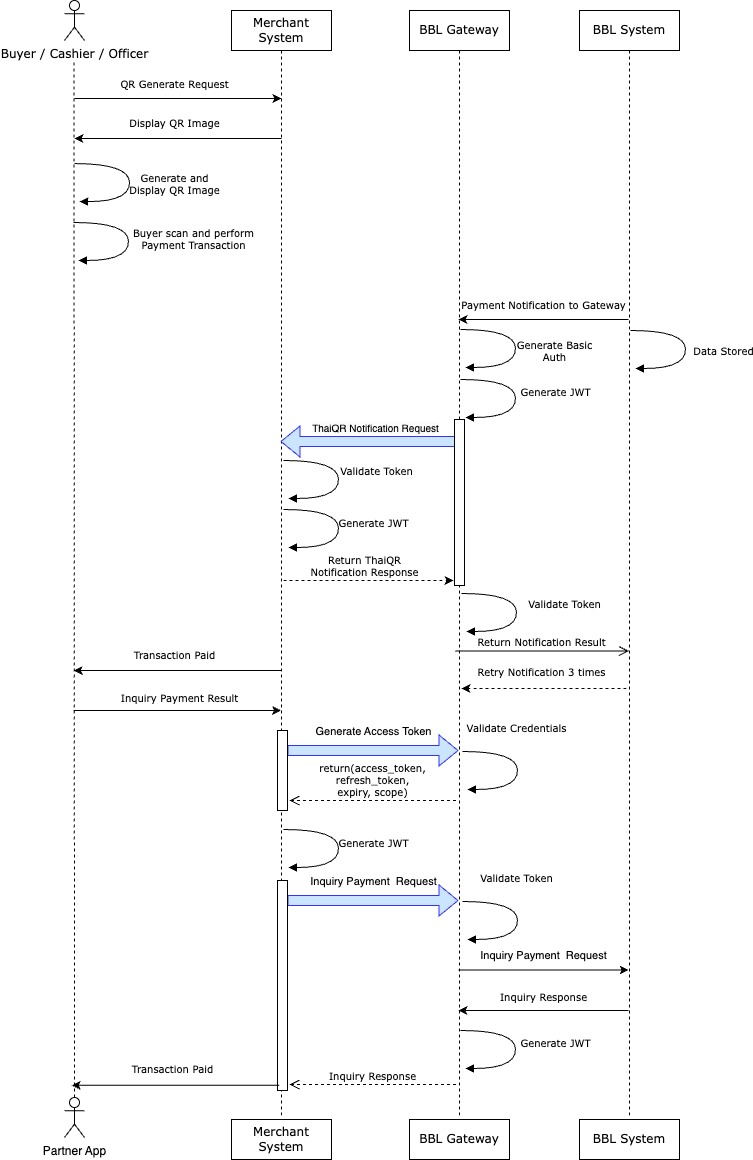

Thai QR Notification

When a customer confirms payment of a QR payment transaction, Bangkok Bank Gateway sends an API request with payment details to merchant's provided notification URL endpoint

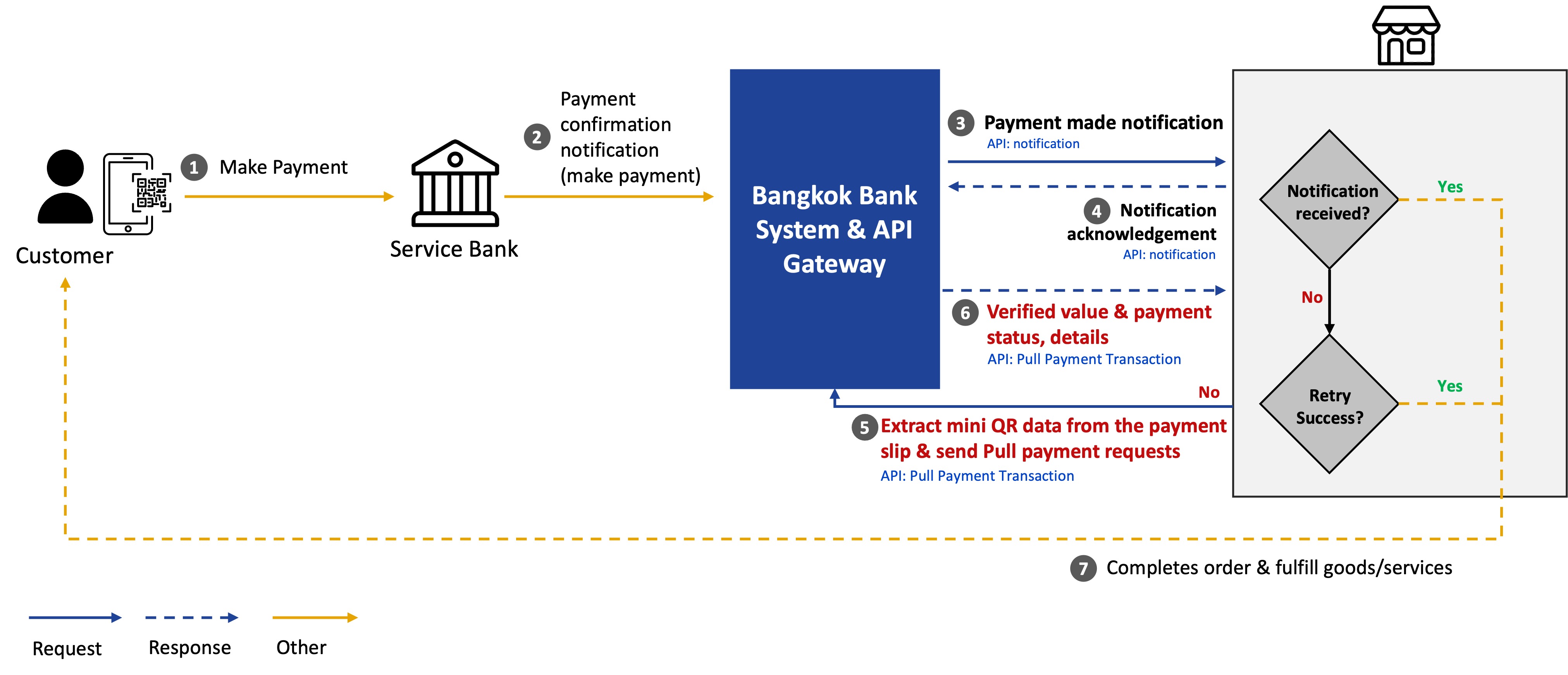

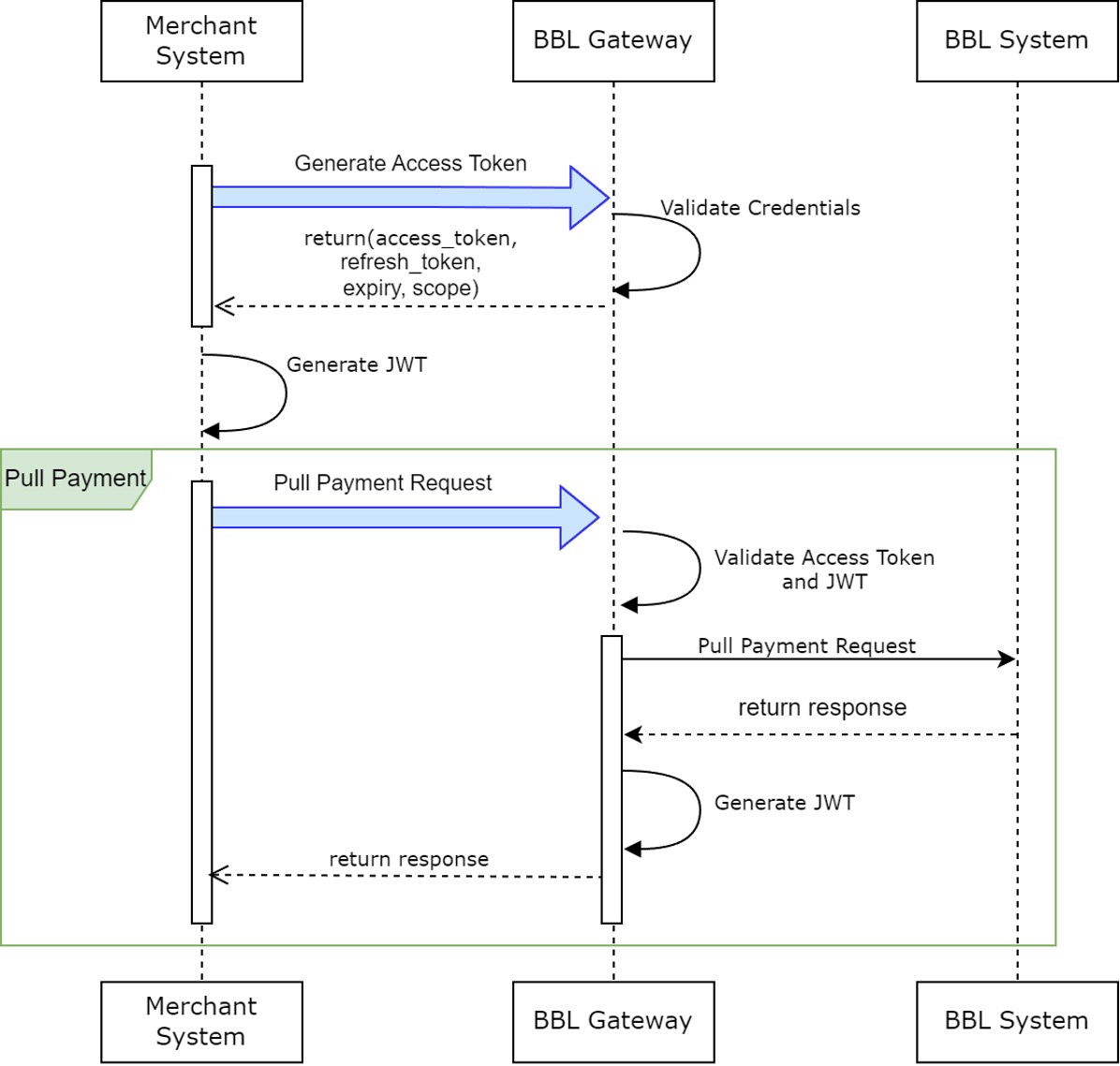

Pull Payment Transaction

This API, as part of the broad product suite, specifically enables you to offer Thai QR payment capabilities to your customers through your application solution.

This is an optional flow subsequent to the core payment process described in the previous section. Pull Payment Transaction API allows verification and information retrieval by using the Transaction Reference embedded in the payment slip (mini-QR) generated from the transaction completed through mobile banking application.

Thai QR Inquiry - for QR code generated by merchant

If notification is not received, then Partner will inquire transaction result via "Thai QR Inquiry API".

Thai QR Payment Inquiry - for QR code generated through Thai QR Code Generation API

This API, as part of the broad product suite, specifically enables you to offer Thai QR payment capabilities to your customers through your application solution. The Payment Inquiry is used to inquire about the payment transaction status by using the qrCodeId that the merchant system receives on the request QR step.

This is an optional flow after the core payment process described in the previous section. In case merchant system does not receive notification; merchant system can use this API to check the payment status.

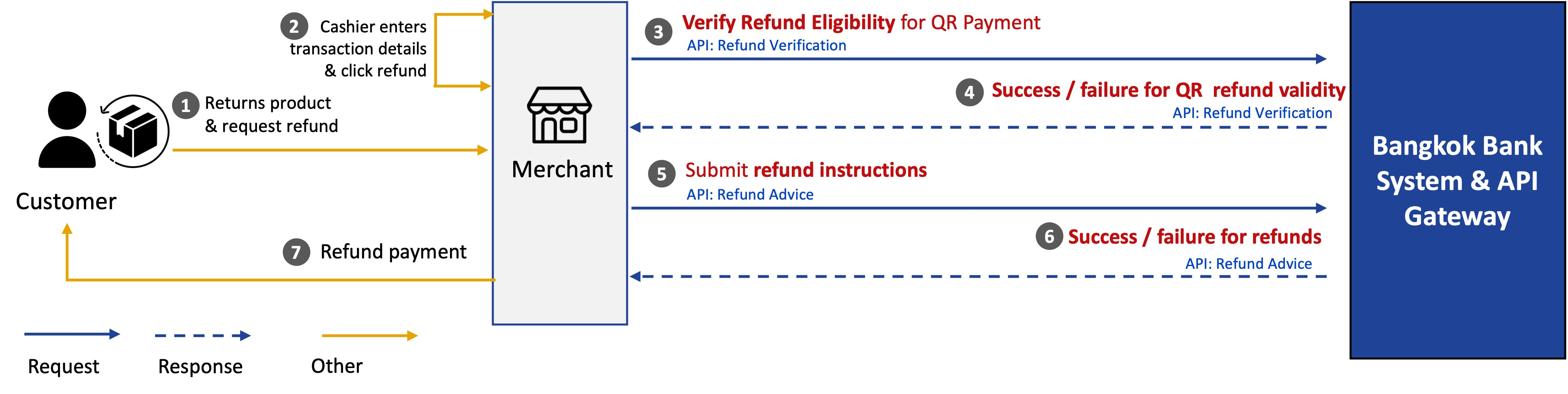

Thai QR Refund

This API, as part of the broad product suite, specifically enables you to offer Thai QR refund capabilities to your customers through your application solution. This is an optional flow after the core payment process described in the previous section. Upon successful QR payment transaction through Bangkok Bank, your customers can make refunds request for the purchased goods or services.

The Refund API consists of three main functions:

- Refund VerificationThis function verifies whether a specific payment transaction has been successfully completed and is eligible for a refund. If verification is successful, the system will mark the transaction as it refundable.

- Refund AdviceAfter successful Refund Verification, this function is used to initiate the refund process.

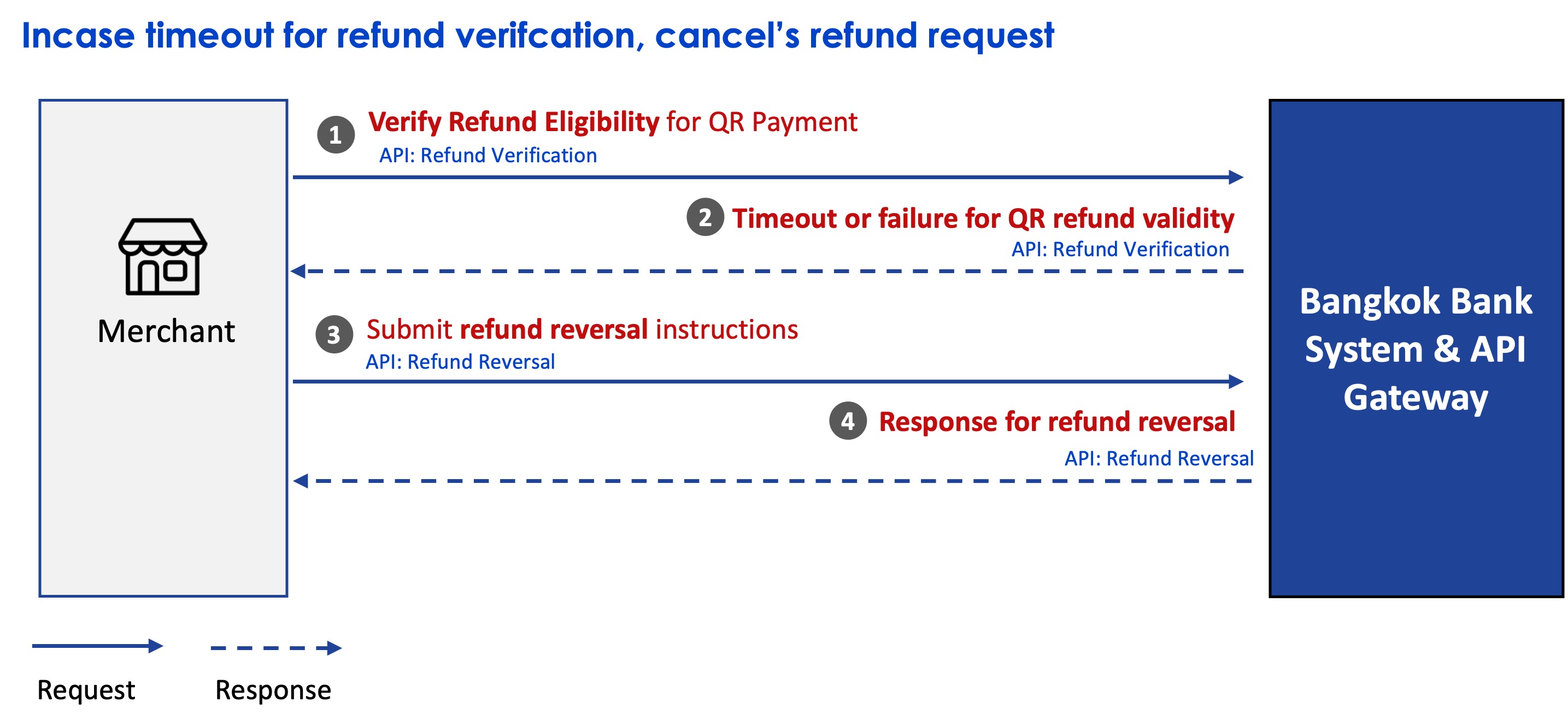

- Refund ReversalThis function allows for cancelling a refund incase refund verification timeout. However, a refund reversal cannot be performed once the Refund Advice has been completed.

Scenario Example

- (A: Refund Verification + B: Refund Advice)Merchant must use these API endpoints to initiate a success Refund for Thai QR payment.

- Customer is looking to return goods or services and initiate a request for refund.

- Cashier enters transaction details and request refund via Merchant Application (For example, POS).

- Merchant systems then request refund verification to initiate flow by using the Refund Verification API (must be before 11pm same day of the payment)

If timeout, merchant system must cancel by requesting refund reversal and retry refund verification again. - Merchant systems verify transaction status whether refunds are possible or not.

- Merchant systems requests refund advice to confirm refund (before 11pm same day)

If timeout, merchant systems can retry refund advice - Merchant systems then receive response for the refund and payment status.

- Customers receives refund payment successfully.

- (A: Refund Verification timeout + C: Refund Reversal)Merchant must use these API endpoints to cancel a refund request if timeout occurs, to request a new refund transaction, please resend the API request via scenario #1.

- Merchant systems request refund verification API to initiate the refund (must be before 11pm same day of the payment).

- Time out occurs for refund verification API.

- If timeout occurs, merchant system must cancel the refund request via refund reversal API.

- Merchant systems then receive response for the refund reversal API.

To perform successful refund, merchant system must then retry or execute API sequence as shown on the scenario #1 above again.

POST /biller/v1/qr-generate

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Sequence Flow

- After the customer check outs and selects to Pay with QR Code, Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- Merchant system submits transaction details with access token and secured JWT claims via QR Code Generation API endpoint to Bangkok Bank API Gateway.

- Bangkok Bank API Gateway then response qr code data with details to Merchant system.

- Merchant system display QR code image to the customer, customer then scans presented QR image and complete payment transaction.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/qr-generate

- PROD:https://api.bangkokbank.com/biller/v1/qr-generate

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.855+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| requestDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2019-12-31 |

| requestTime | String | 8 | Y | Transaction time Format HH:mm:ss | 17:50:50 |

| merchantName | String | 50 | Y | Merchant/Shop English Name | ABC SHOP |

| merchantCountry | String | 2 | Y | Country of Merchant | TH |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 500.00 |

| cardNetworkPermList | Object[] | ||||

| cardNetworkPermList[] .cardNetworkPerm | String | 2 | Y | Card network code for transaction’s payment channel:

| 01 |

| qrPromptpayInfo | Object | ||||

| qrPromptpayInfo .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| qrPromptpayInfo .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| qrPromptpayInfo .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| qrPromptpayInfo .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

Request Body Example

{

"requestDate": "2018-12-31",

"requestTime": "17:50:50",

"merchantName": "ABC SHOP",

"merchantCountry": "TH",

"amount": "500.00",

"cardNetworkPermList": [

{

"cardNetworkPerm": "01"

}

],

"qrPromptpayInfo": {

"billerId": "010555604520701",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/qr-generate' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"requestDate": "2018-12-31",

"requestTime": "17:50:50",

"merchantName": "ABC SHOP",

"merchantCountry": "TH",

"amount": "500.00",

"cardNetworkPermList": [

{

"cardNetworkPerm": "01"

}

],

"qrPromptpayInfo": {

"billerId": "010555604520701",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .qrCodeId | String | 20 | Y | Unique identifier of QR code, used for inquiry | 114455 |

| data .qrReference | String | 20 | Y | QR reference generated by BBL backend, for display/printing only, NOT used for inquiry | 602GBB00000000000000 |

| data .qrData | String | 500 | Y | QR code data, for generate QR image | 00020101021230610016A000000677010112011501075360003745302101112221112030414225303764540520.025802TH5908DEF SHOP6304FAA4 |

| data .cardNetworkPermList | Object[] | ||||

| data .cardNetworkPermList[] .cardNetworkCode | String | 2 | Y | Card network code for transaction’s payment channel:

| 01 |

Response Body Example (Success)

{

"responseMesg": "Success",

"responseCode": "000",

"data": {

"qrCodeId": "114455",

"qrReference": "602GBB00000000000000",

"qrData": "00020101021230610016A000000677010112011501075360003745302101112221112030414225303764540520.025802TH5908DEF SHOP6304FAA4",

"cardNetworkList": [

{

"cardNetworkCode": "01"

}

]

}

}Response Body Example (Failure)

{

"responseMesg": "Invalid data",

"responseCode": "211"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 054 | Internal System Unavailable | Response of business backend |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data | Response of business backend |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

POST {MERCHANT_VERIFY_URL}

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Request URL

- PROD:{MERCHANT_VERIFY_URL}

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Basic authentication Token encode with Base64 String = {username}:{password} Basic {token} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| billerId | String | 15 | Y | TaxId and Suffix of the Payee | 123456789012345 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 1500.75 |

| transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| reference1 | String | 30 | Y | First Reference number of the transaction from Partner | 123456789 |

| reference2 | String | 30 | N | Second Reference number of the transaction from Partner | 1124579998 |

| reference3 | String | 30 | N | Second Reference number of the transaction from Partner | 22555347 |

Request Body Example

{

"billerId": "123456789012345",

"amount": "1500.75",

"transDate": "2018-03-15",

"transTime": "15:21:50",

"reference1": "123456789",

"reference2": "1124579998",

"reference3": "22555347"

}Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| shopName | String | 50 | N | Merchant/Shop English Name This field can be English CAPITAL letter, Numeric (0-9) and special characters. Invalid special character set:

| ITTest |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"shopName": "ITTest"

}Response Body Example (Failure)

{

"responseMesg": "Invalid data",

"responseCode": "211"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 200 | 052 | Unknown Biller ID | Invalid Biller ID |

| 200 | 054 | System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Transaction not found |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data |

|

| 200 | 215 | Invalid token | Invalid JWT Token |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

| 401 | Unauthorized | Authorization failure |

POST {MERCHANT_NOTIFICATION_URL}

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Basic Authentication. Format Basic (Base64Encode(username:password))

Request URL

- PROD:{MERCHANT_NOTIFICATION_URL}

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Basic authentication Token encode with Base64 String = {username}:{password} Basic {token} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| data | Object | 15 | Y | ||

| data .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 123456789012345 |

| data .fromBank | String | 3 | Y | From bank code. Right-aligned and left-padded with zeros. | 002 |

| data .amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 1500.75 |

| data .approvalCode | String | 6 | N | 123456 | |

| data .retryFlag | String | 1 | Y | Notification retry flag:

| N |

| data .transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| data .transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| data .termType | String | 2 | Y | Terminal Type (Channel):

| 80 |

| data .fromName | String | 50 | N | Payer name Eng/Thai (UTF-8) | ITTest |

| data .reference1 | String | 30 | Y | First Reference number of the transaction from Partner | 123456789 |

| data .reference2 | String | 30 | N | Second Reference number of the transaction from Partner | 1124579998 |

| data .reference3 | String | 30 | N | Second Reference number of the transaction from Partner | 22555347 |

| data .bankRef | String | 25 | N | BBL reference | 2022101914273423001321408 |

| type | String | Application type Fixed Value: ThaiQR | ThaiQR |

Request Body Example

{

"data": {

"billerId": "123456789012345",

"fromBank": "002",

"amount": "1500.75",

"approvalCode": "123456",

"retryFlag": "N",

"transDate": "2017-11-06",

"transTime": "17:57:50",

"termType": "10",

"fromName": "ITTest",

"reference1": "123456789",

"reference2": "20171106151550",

"reference3": "5555555",

"bankRef": "2022101914273423001321408"

},

"type": "ThaiQR"

}Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success"

}Response Body Example (Failure)

{

"responseMesg": "Service Provider not ready",

"responseCode": "341"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 200 | 052 | Unknown Biller ID | Invalid Biller ID |

| 200 | 054 | System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Transaction not found |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data |

|

| 200 | 215 | Invalid token | Invalid JWT Token |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

| 401 | Unauthorized | Authorization failure |

POST /biller/v1/pull-payment

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Sequence Flow

- After the Customer have completed a transaction, Merchant system is able to check the transaction status and its details by using the Pull Payment Transaction API function.

- Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- The Merchant system submits transaction details with access token and secured JWT claims via Pull Payment Transaction API endpoint to Bangkok Bank API Gateway.

- The Bangkok Bank API Gateway then responds with transaction details to Merchant system.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/pull-payment

- PROD:https://api.bangkokbank.com/biller/v1/pull-payment

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.855+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| transRef | String | 25 | Y | Unique transaction reference number retrieved from payment slip for verifying payment transaction. | 2022011211544723000693608 |

| destBank | String | 3 | Y | Payer Bank Code retrieved from payment slip | 002 |

| reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 150.00 |

Request Body Example

{

"billerId": "013456789012301",

"transRef": "2022011211544723000693608",

"destBank": "002",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342",

"amount": "150.00"

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/pull-payment' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"billerId": "013456789012301",

"transRef": "2022011211544723000693608",

"destBank": "002",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342",

"amount": "150.00"

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .transRef | String | 25 | Y | Unique transaction reference number retrieved from payment slip for verifying payment transaction. Value must be exactly the same as the value in HTTP Request Body above. | 2022011211544723000693608 |

| data .sendingBank | String | 3 | Y | Payer Bank code retrieved from payment slip | 002 |

| data .receivingBank | String | 3 | Y | Merchant Bank code | 004 |

| data .transDate | String | 10 | N | Transaction date Format yyyy-MM-dd | 2023-09-20 |

| data .transTime | String | 8 | N | Transaction time Format HH:mm:ss | 11:54:43 |

| data .amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 Value must be exactly the same as the value in HTTP Request Body above. | 150.00 |

| data .countryCode | String | 2 | N | TH | |

| data .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| data .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| data .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

| data .sender | Object | ||||

| data .sender .displayName | String | 50 | N | Name of Sender | สมชาย นามสมมติ |

| data .sender .name | String | 50 | N | Name of Sender | Somchai Namsommuth |

| data .sender .type | String | 12 | N | In case paid by e-Wallet only | EWALLETID |

| data .sender .value | String | 128 | N | In case paid by e-Wallet only | 002556006918201 |

| data .sender .account | Object | ||||

| data .sender .account .type | String | 12 | Y | In case paid by account only | BANKAC |

| data .sender .account .value | String | 40 | Y | In case paid by account only | 2750001253 |

| data .sender .receiver | Object | ||||

| data .sender .receiver .displayName | String | 50 | N | Name of Receiver | SUNDAY INS - QRUATOFFLINE |

| data .sender .proxy | Object | ||||

| data .sender .proxy .type | String | 12 | Y | Account type of receiver | BILLERID |

| data .sender .proxy .value | String | 40 | Y | Account value of receiver | 013456789012301 |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"transRef": "2022011211544723000693608",

"sendingBank": "002",

"receivingBank": "004",

"transDate": "2023-09-20",

"transTime": "11:54:43",

"amount": "150.00",

"countryCode": "TH",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342",

"sender": {

"displayName": "สมชาย นามสมมติ",

"name": "Somchai Namsommuth",

"account": {

"type": "BANKAC",

"value": "2750001253"

}

},

"receiver": {

"displayName": "SUNDAY INS - QRUATOFFLINE",

"proxy": {

"type": "BILLERID",

"value": "013456789012301"

}

}

}

}Response Body Example (Failure)

{

"responseCode": "209",

"responseMesg": "Transaction reference does not exists"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 001 | Invalid parameter input |

|

| 200 | 209 | Transaction reference does not exist |

|

| 200 | 213 | Transaction reference does not exist |

|

| 200 | 211 | Invalid data | The biller id, ref1, ref2, ref3 & amount differs from the request. |

| 200 | 888 | Other Errors |

|

POST /biller/v1/qr-inquiry

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Note:

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/qr-inquiry

- PROD:https://api.bangkokbank.com/biller/v1/qr-inquiry

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| billerId | String | 15 | Y | TaxId and Suffix of the Payee | 123456789012345 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 1500.75 |

| transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| reference1 | String | 30 | Y | First Reference number of the transaction from Partner | 123456789 |

| reference2 | String | 30 | N | Second Reference number of the transaction from Partner | 1124579998 |

| reference3 | String | 30 | N | Second Reference number of the transaction from Partner | 22555347 |

Request Body Example

{

"billerId": "123456789012345",

"amount": "1500.25",

"transDate": "2018-03-15",

"reference1": "123456789",

"reference2": "1124579998",

"reference3": "1124579998"

}Request Example

curl --request POST 'https://{{api-host}}/biller/v1/qr-inquiry' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Request-Ref: TXN20171120-0000023' \

--header 'Content-Type: application/json' \

--data-raw '{

"billerId": "123456789012345",

"amount": "1500.25",

"transDate": "2018-03-15",

"reference1": "123456789",

"reference2": "1124579998",

"reference3": "1124579998"

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 123456789012345 |

| data .transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2022-10-18 |

| data .transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| data .termType | String | 2 | Y | Terminal Type (Channel):

| 80 |

| data .amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 1500.75 |

| data .reference1 | String | 30 | Y | First Reference number of the transaction from Partner | 120213405 |

| data .reference2 | String | 30 | N | Second Reference number of the transaction from Partner | 120213405 |

| data .reference3 | String | 30 | N | Second Reference number of the transaction from Partner | 120213405 |

| data .fromBank | String | 3 | Y | From bank code. Right-aligned and left-padded with zeros. | 002 |

| data .fromName | String | 50 | N | Payer name Eng/Thai (UTF-8) | ITTest |

| data .bankRef | String | 25 | N | BBL reference | |

| data .approvalCode | String | 6 | N | 123456 |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"billerId": "123456789012345",

"transDate": "2017-11-16",

"transTime": "17:57:50",

"termType": "10",

"amount": "1500.75",

"reference1": "120213405",

"reference2": "120213405",

"reference3": "120213405",

"fromBank": "001",

"fromName": "ITTest",

"approvalCode": "123456"

}

}Response Body Example (Failure)

{

"responseMesg": "Service Provider not ready",

"responseCode": "341"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 200 | 054 | System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Transaction not found |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data |

|

| 200 | 215 | Invalid token | Invalid JWT Token |

| 200 | 341 | Service not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

| 401 | Unauthorized | Authorization failure | |

| 403 | 052 | Unknown Biller ID | Biller ID or Service Code is not registered |

POST /biller/v1/payment-inquiry

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Note:

Sequence Flow

- In case that Merchant system does not receive any payment notification for completed transactions, merchant systems can check the transaction status by using the Thai QR Payment Inquiry API function.

- Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- The Merchant system then submits transaction details along with the access token and secure JWT claims to the Bangkok Bank API Gateway via the Thai QR Payment Inquiry API endpoint.

- Bangkok Bank API Gateway then responds with the transaction status, the payment status.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/payment-inquiry

- PROD:https://api.bangkokbank.com/biller/v1/payment-inquiry

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Access token of OAuth token Client Credential type Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| inquiryDate | String | 10 | Y | Inquiry date Format yyyy-MM-dd | 2018-12-31 |

| inquiryTime | String | 8 | Y | Inquiry time Format HH:mm:ss | 17:57:50 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 500.00 |

| qrCodeId | String | 20 | Y | Unique identifier of QR code, used for inquiry | 10000000000000000000 |

| qrPromptpayInfo | Object | ||||

| qrPromptpayInfo .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| qrPromptpayInfo .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| qrPromptpayInfo .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| qrPromptpayInfo .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

Request Body Example

{

"inquiryDate": "2018-12-31",

"inquiryTime": "17:57:50",

"amount": "500.00",

"qrCodeId": "10000000000000000000",

"qrPromptpayInfo": {

"billerId": "010555604520701",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/payment-inquiry' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"inquiryDate": "2018-12-31",

"inquiryTime": "17:57:50",

"amount": "500.00",

"qrCodeId": "10000000000000000000",

"qrPromptpayInfo": {

"billerId": "010555604520701",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .statusCode | String | 2 | Y | Status Code of payment:

| 00 |

| data .statusMesg | String | 100 | Y | Status Message of payment:

| Approved |

| data .cardNetworkCode | String | 2 | N | Return if Status Code is 00 Card network code for transaction's payment channel:

| 01 |

| data .transDate | String | 10 | N | Return if Status Code is 00 Transaction date Format yyyy-MM-dd | 2018-12-31 |

| data .transTime | String | 8 | N | Return if Status Code is 00 Transaction time Format HH:mm:ss | 17:57:50 |

| data .approvalCode | String | 6 | N | Return if Status Code is 00 BBL reference | 650258 |

| data .transactionId | String | 12 | N | Return if Status Code is 00 Payment Transaction ID | 100000000001 |

| data .qrPromptpayInfo | Object | ||||

| data .qrPromptpayInfo .termType | String | 2 | Y | Terminal Type (Channel):

| 80 |

| data .qrPromptpayInfo .fromBank | String | 3 | Y | From bank code | SCB |

| data .qrPromptpayInfo .fromName | String | 50 | N | Payer name Eng/Thai (UTF-8) | Joe |

| data .qrPromptpayInfo .bankRef | String | 50 | N | BBL reference | 242848204 |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"statusCode": "00",

"statusMesg": "Approved",

"cardNetworkCode": "01",

"transDate": "2018-12-31",

"transTime": "17:51:35",

"approvalCode": "650258",

"transactionId": "100000000001",

"qrPromptpayInfo": {

"termType": "80",

"fromBank": "SCB",

"fromName": "Joe",

"bankRef": "242848204"

}

}

}Response Body Example (Failure)

{

"responseMesg": "Invalid data",

"responseCode": "211"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 054 | Internal System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Response of business backend |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data | Response of business backend |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

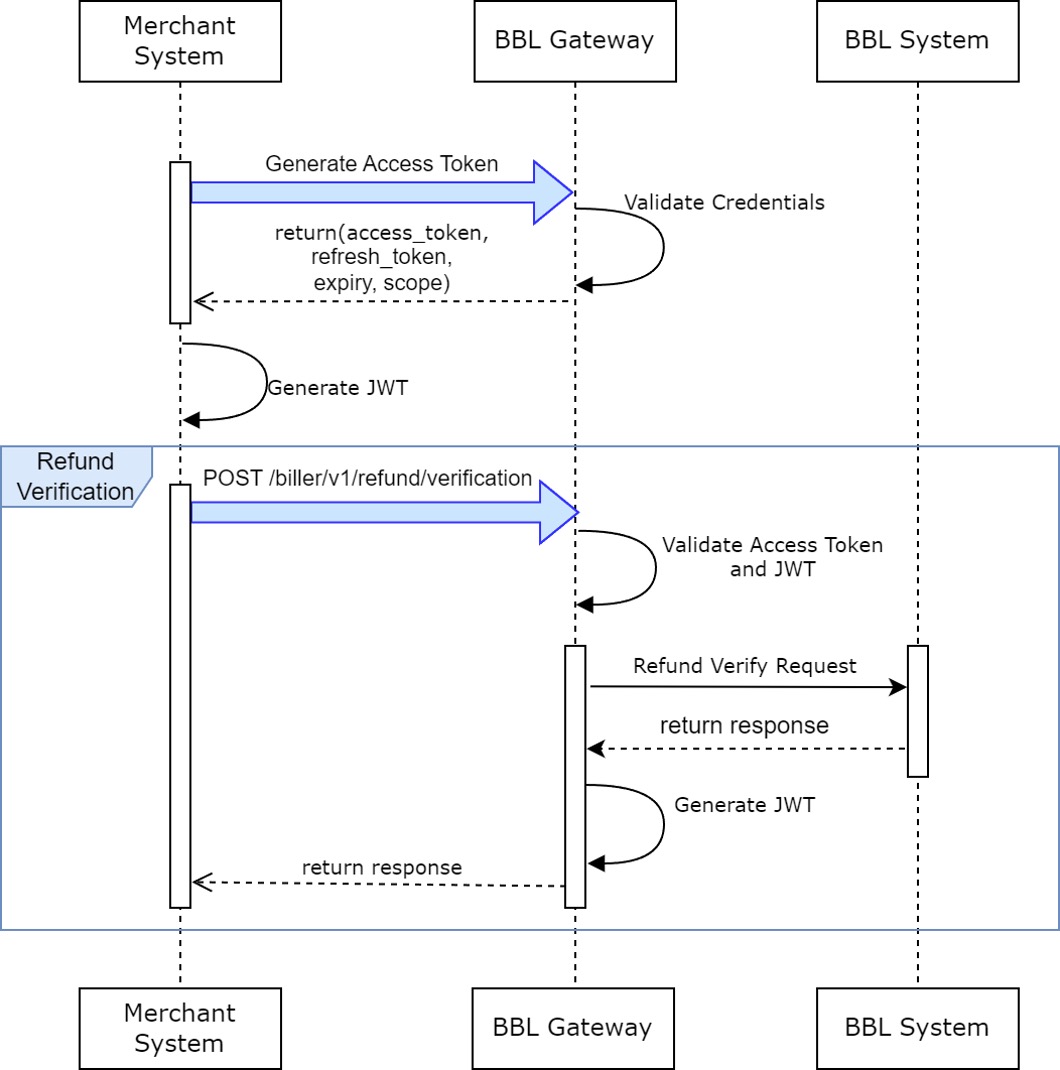

POST /biller/v1/refund/verification

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Sequence Flow

- In case that customer request to cancel the completed payment transaction, merchant system can request to cancel the payment transaction by using the refund verification function.

- Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- Merchant system submits transaction details with access token and secured JWT claims via Thai QR Refund Verification API endpoint to Bangkok Bank API Gateway.

- Bangkok Bank API Gateway then response whether the cancellation can be made or not.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/refund/verification

- PROD:https://api.bangkokbank.com/biller/v1/refund/verification

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Access token of OAuth token Client Credential type Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 500.00 |

| approvalCode | String | 6 | Y | Approval Code | 650258 |

| cardNetworkCode | String | 2 | Y | Card network code for transaction's payment channel:

| 01 |

| qrPromptpayInfo | Object | ||||

| qrPromptpayInfo .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| qrPromptpayInfo .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| qrPromptpayInfo .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| qrPromptpayInfo .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

Request Body Example

{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/refund/verification' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .transactionId | String | 12 | Y | Payment Transaction ID | 65478923 |

| data .fromName | String | 50 | N | Buyer Name | ABC XYZ |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"transactionId": "65478923",

"fromName": "ABC XYZ"

}

}Response Body Example (Failure)

{

"responseMesg": "Transaction already void",

"responseCode": "213"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 054 | Internal System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Response of business backend |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data | Response of business backend |

| 200 | 213 | Transaction already void | Response of business backend |

| 200 | 214 | Trans too old to void advice |

|

| 200 | 215 | Trans too old to pre-void |

|

| 200 | 216 | Voiding not allowed on this Transaction | Response of business backend |

| 200 | 217 | This transaction cannot be voided | Response of business backend |

| 200 | 218 | Voiding decline by host | Response of business backend |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

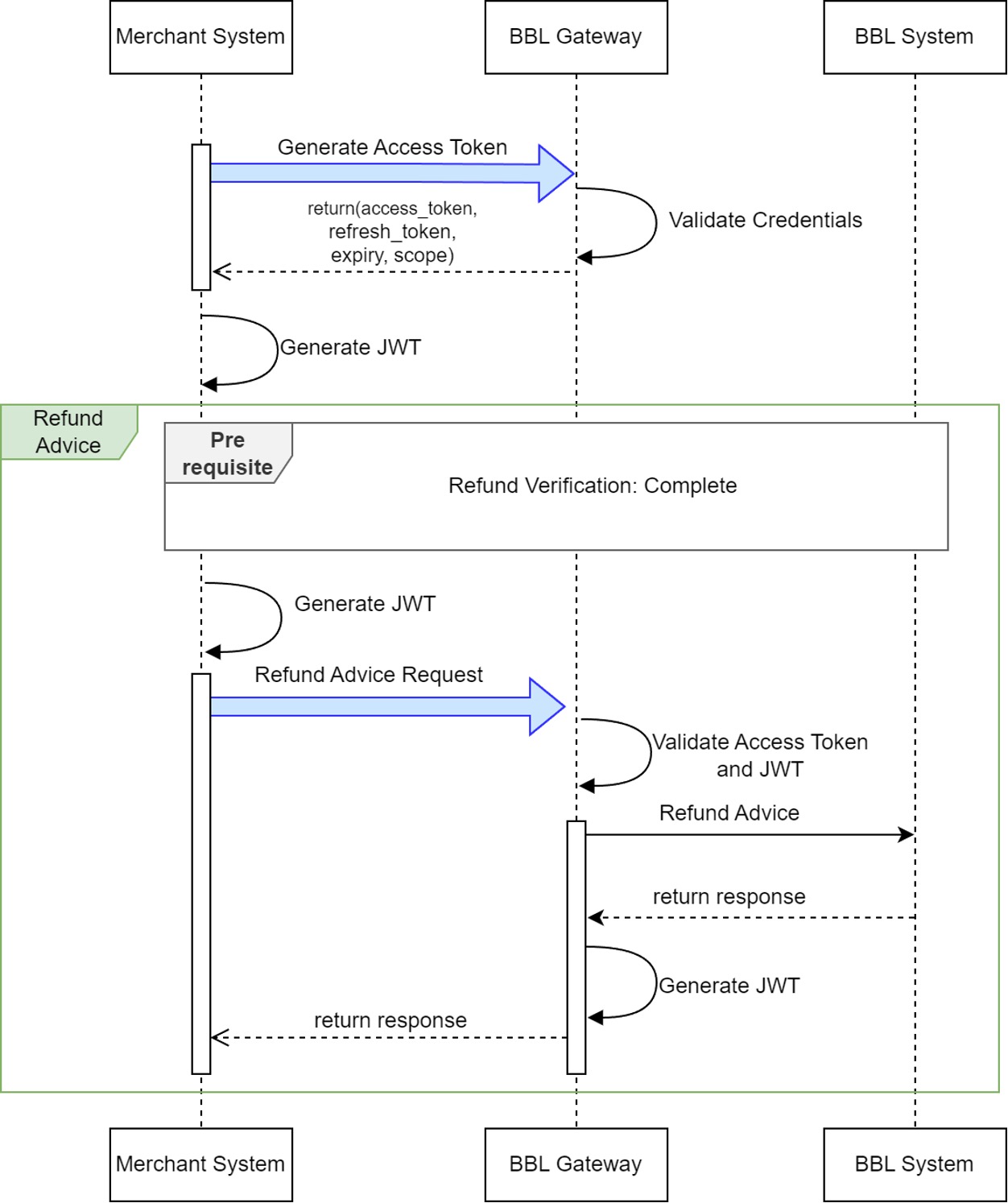

POST /biller/v1/refund/advice

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Sequence Flow

- After successful verification, to confirm cancel completed payment transaction, merchant system can proceed this action by using the refund advice function.

- Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- Merchant system submits transaction details with access token and secured JWT claims via Thai QR Refund Advice API endpoint to Bangkok Bank API Gateway.

- Bangkok Bank API Gateway then response the status.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/refund/advice

- PROD:https://api.bangkokbank.com/biller/v1/refund/advice

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Access token of OAuth token Client Credential type Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 500.00 |

| approvalCode | String | 6 | Y | Approval Code | 650258 |

| cardNetworkCode | String | 2 | Y | Card network code for transaction's payment channel:

| 01 |

| qrPromptpayInfo | Object | ||||

| qrPromptpayInfo .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| qrPromptpayInfo .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| qrPromptpayInfo .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| qrPromptpayInfo .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

Request Body Example

{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/refund/advice' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .transactionId | String | 12 | Y | Payment Transaction ID | 65478923 |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"transactionId": "65478923"

}

}Response Body Example (Failure)

{

"responseMesg": "Invalid data",

"responseCode": "211"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 054 | Internal System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Response of business backend |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data | Response of business backend |

| 200 | 213 | Transaction already void | Response of business backend |

| 200 | 214 | Trans too old to void advice |

|

| 200 | 215 | Trans too old to pre-void |

|

| 200 | 216 | Voiding not allowed on this Transaction | Response of business backend |

| 200 | 217 | This transaction cannot be voided | Response of business backend |

| 200 | 218 | Voiding decline by host | Response of business backend |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

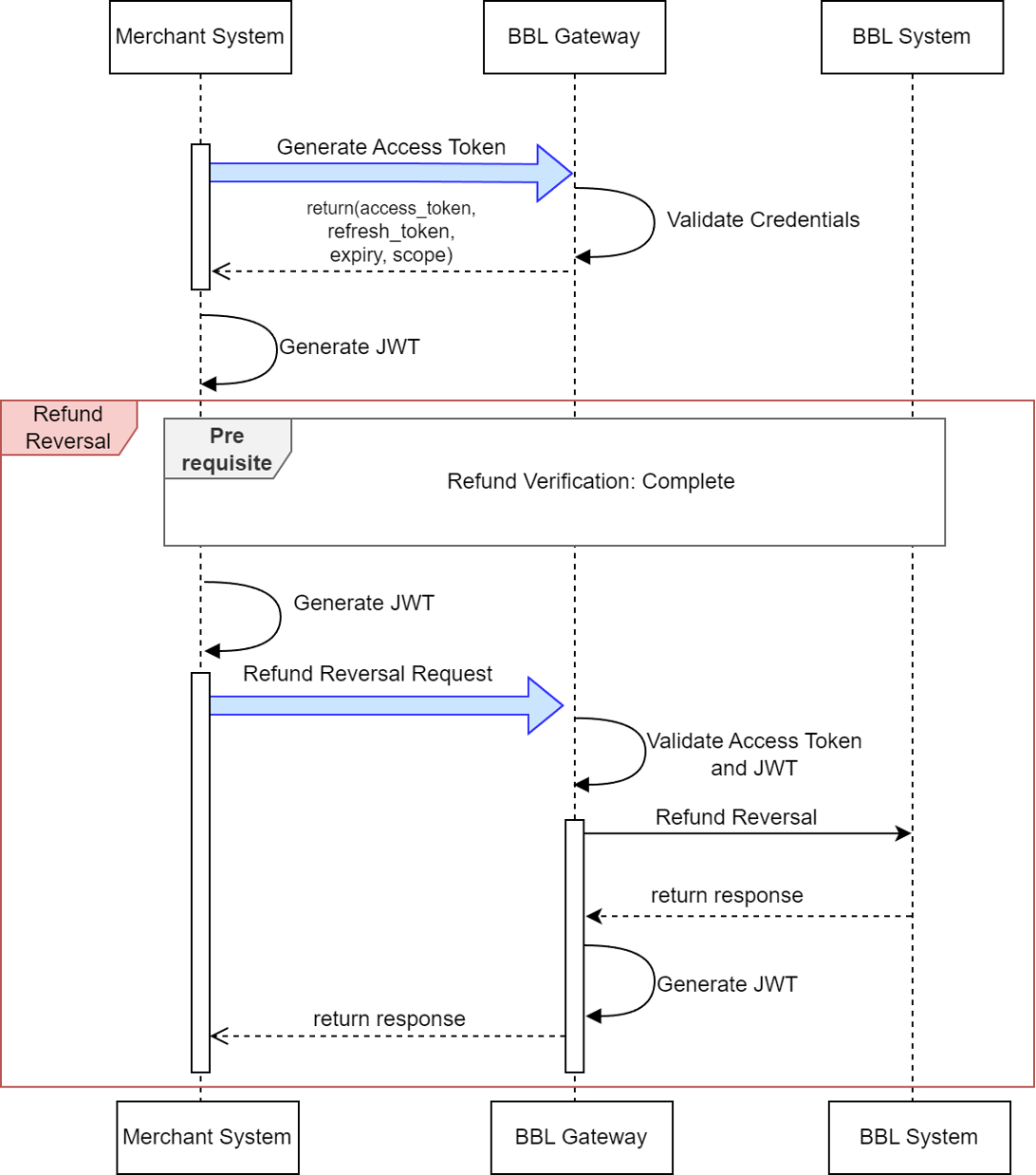

POST /biller/v1/refund/reversal

Web Services: RESTful JSON

HTTP Method: POST

Character encoding: UTF-8

Content Type: application/json

Authorization: Bearer authentication (OAuth token Client Credential grant type)

Sequence Flow

- In case of timeout, merchant can cancel refund request by using the refund reversal function.

- Merchant system authenticates with Bangkok Bank API Gateway by getting access token from OAuth Endpoint.

- Merchant system submits transaction details with access token and secured JWT claims via Thai QR Refund Reversal API endpoint to Bangkok Bank API Gateway.

- Bangkok Bank API Gateway then response the status.

Request URL

- Sandbox:https://api-sandbox.bangkokbank.com/biller/v1/refund/reversal

- PROD:https://api.bangkokbank.com/biller/v1/refund/reversal

Request Headers

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| Authorization | String | 100 | Y | Access token of OAuth token Client Credential type Bearer {accessToken} | Bearer 3CMwLhLwOZL3mKOI6iJoKNs3Q4NA |

| Signature | String | Y | Digital Signature sign with JWT RSA256 | eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJqadEIuNEPkxgfD8fzh2TlfOKVXwNGVr_p9TTCGkJ672MbkSoJZqcQVi-Pm-IaVX7hE8… | |

| Request-Ref | String | 50 | Y | Transaction tracking no. (Unique) | TXN20171120-0000023 |

| Transmit-Date-Time | String | 29 | Y | Request transmit date and time Format yyyy-MM-dd’T’HH:mm:ss.SSS+|-hh:mm | 2017-03-15T15:23:11.001+07:00 |

Request Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| transDate | String | 10 | Y | Transaction date Format yyyy-MM-dd | 2018-12-31 |

| transTime | String | 8 | Y | Transaction time Format HH:mm:ss | 15:21:35 |

| amount | String | 16 | Y | Payment amount = 13 digits + . + 2 decimals Ex. xxxx.xx Maximum number is 9999999999999.99 | 500.00 |

| approvalCode | String | 6 | Y | Approval Code | 650258 |

| cardNetworkCode | String | 2 | Y | Card network code for transaction's payment channel:

| 01 |

| qrPromptpayInfo | Object | ||||

| qrPromptpayInfo .billerId | String | 15 | Y | TaxId and Suffix of the Payee | 010555604520701 |

| qrPromptpayInfo .reference1 | String | 20 | Y | First Reference number of the transaction from Merchant Text A-Z capital letters | 002123456789001 |

| qrPromptpayInfo .reference2 | String | 20 | N | Second Reference number of the transaction from Merchant Text A-Z capital letters | 70012345000000123456 |

| qrPromptpayInfo .reference3 | String | 20 | N | Third Reference number of the transaction from Merchant Text A-Z capital letters | 5301234231112342 |

Request Body Example

{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}Request Example

curl --location --globoff 'https://{{api-host}}/biller/v1/refund/reversal' \

--header 'Authorization: Bearer {{access-token}}' \

--header 'Signature: {{request-signature}}' \

--header 'Request-Ref: TXN20231120-0000023' \

--header 'Transmit-Date-Time: 2017-03-15T15:23:11.001+07:00' \

--header 'Content-Type: application/json' \

--data '{

"transDate": "2018-12-31",

"transTime": "15:21:35",

"amount": "500.00",

"approvalCode": "650258",

"cardNetworkCode": "01",

"qrPromptpayInfo": {

"billerId": "010555604520711",

"reference1": "002123456789001",

"reference2": "70012345000000123456",

"reference3": "5301234231112342"

}

}'Response Body

| Parameter | Type | Size | Mandatory | Description | Example/Values |

|---|---|---|---|---|---|

| responseCode | String | 3 | Y | Response Code | 000 |

| responseMesg | String | 50 | Y | Response Message | success |

| data | Object | ||||

| data .transactionId | String | 12 | Y | Payment Transaction ID | 65478923 |

Response Body Example (Success)

{

"responseCode": "000",

"responseMesg": "Success",

"data": {

"transactionId": "65478923"

}

}Response Body Example (Failure)

{

"responseMesg": "Invalid data",

"responseCode": "211"

}Response Code

| HTTP Status | Response Code | Response Message | Remark |

|---|---|---|---|

| 200 | 000 | Success | Success |

| 400 | 211 | Invalid format Signature | Header in response does not have signature. |

| 400 | 211 | Invalid data |

|

| 401 |

| ||

| 403 | 052 | Unknown Biller ID | Biller id or service code is not registered. |

| 405 |

| ||

| 429 |

| ||

| 200 | 054 | Internal System Unavailable | Response of business backend |

| 200 | 209 | Transaction not found | Response of business backend |

| 200 | 210 | Time out | Response of business backend |

| 200 | 211 | Invalid data | Response of business backend |

| 200 | 213 | Transaction already void | Response of business backend |

| 200 | 214 | Trans too old to void advice |

|

| 200 | 215 | Trans too old to pre-void |

|

| 200 | 216 | Voiding not allowed on this Transaction | Response of business backend |

| 200 | 217 | This transaction cannot be voided | Response of business backend |

| 200 | 218 | Voiding decline by host | Response of business backend |

| 200 | 341 | Service Provider not ready | Response of business backend |

| 200 | 888 | Other Errors | Response of business backend |

Response HTTP Status

| HTTP Status | Reason Phrase |

|---|---|

| 200 | Success |

| 401 | Unauthorized |

| 403 | Forbidden |

| 400 | Bad Request |

| 404 | Resource not found |

| 429 | Too many requests |

| 500 | Internal Error |

| 503/504 | Service Unavailable |